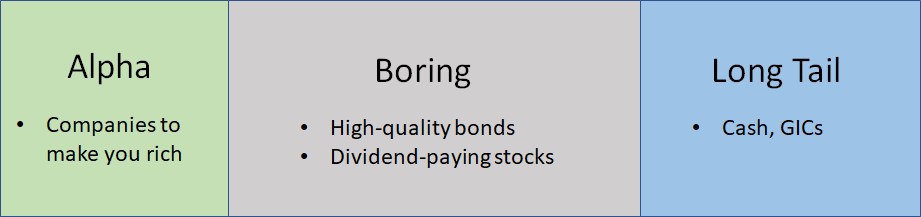

Ever wonder how professional managers handle all that money and what they do with their own? Often, it comes down to two things: alpha and long tail.

Alpha is the portion of your portfolio that chases huge financial returns. It’s the component that swings for home runs by searching for big gains. Tech companies and stocks in new markets are prime examples. Tesla, marijuana-co, Netflix, and Beyond Meat—currently or in the past—fit into this category. And their potential upside isn’t just to double your money, they can grow it by 10-20 times. That’s why they’re called alpha and everyone should have an allotment dedicated to this.

Professionals hold 10-20 of these companies with the strategy that winners will grossly outweigh the dogs. Why? Because nobody knows which stocks will make it. You’re not only guessing whether the market is real, you’re also gambling on whether this is the right pick. Everyone knows that not every company is successful and many new markets never take off. Just look at the computer business, loads of players were great at the beginning only to crash and burn when goings got tough.

Long tail is the exact opposite. It’s the allocation waiting for the world to end. This type of risk is called long tail because it doesn’t happen very often. As a matter of fact, it’s really quite rare. But nobody knows when the big quake is coming so have some money dedicated to this.

If the market tanks by half, you should still be able to live. It may only be on beans and rice but at least you’ll have something. Then the rest of your dough should be sitting in dividend-paying stocks or high-quality bonds. Nothing too risky, nothing too big, just the types that provide decent returns.

What percentages you put into each compartment is your choice. Just make sure you’re ready for the big one and if a Canadian, hold alpha in TFSA.