Probably the largest debate in society today is over healthcare, especially in the States. We Canadians like to brag about our system but whether you’re in Oshawa or Omaha, nobody understands their plan. And when you sit down and really look at it, we’re not that different.

There are two parts to any system: who pays and who provides. In this article, we’ll only discuss the money. There are six components to our Canadian system:

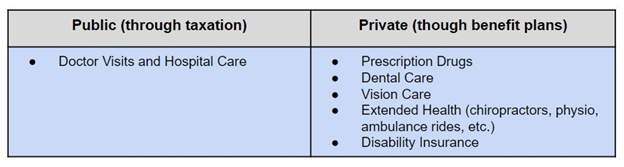

Potentially expensive events are provided by the province while the rest is covered by private plans. And though we’re generalizing to simplify, governments actually cover parts of the items on the right. Anyway, in the US they mess with the left-side column.

US

The US has five systems that pay for doctor visits and hospital care (DVHC):

- Medicare (those over 65) – government paid

- Medicaid (low-income persons) – government paid

- VA (members of the military) – government paid (and government supplied)

- Corporate Plans (employees with benefits) – private paid

- Individual Plans (employees without benefits) – private paid

When it comes to doctor visits and hospital care, many are treated like Canadians but most are covered by the same system we use for seeing a dentist. Now this situation would be fine if everyone was covered but that’s not the case. 28 million Americans are walking around without DVHC coverage. So is it a big deal?

Obamacare

Obamacare tried to address this situation in three ways.

- It forced companies with over 50 employees to provide healthcare that subscribed to a minimum standard (including DVHC).

- Disallowed insurers from charging more for people with pre-existing conditions in the individual market.

- Made it illegal to not carry insurance by forcing individuals to purchase a plan through government subsidized exchanges, or face a penalty when filing their tax return. (Called the individual mandate.)

Before Obamacare, 50 million people were not covered. Mostly those without a company plan, whose individual premiums were too high to buy (say, pre-existing conditions), or they simply didn’t want one. This number came down by 22 million when additional companies were forced into providing plans (10 million), many of those with pre-existing conditions could now buy in, and government subsidies attracted others (total 12 million individuals).

Pre-existing conditions

Now Canadians already know about pre-existing conditions. It’s what we do with car insurance. If you hold a number of tickets, premiums go up. Same when it comes to life — fat people who smoke pay more. But when it comes to hospitalizations this was poor policy. Sell me all the personal responsibility you want, I can’t help myself from having a heart attack. That’s why everyone’s favourite president disallowed any further attacks on this piece of the plan.

Canadians also understand the idea of receiving a fine if you don’t insure. We do the same thing when it comes to cars. The fine for driving without insurance in Alberta is over $2,800. (Mostly because applicable drivers often have drunk driving offences so premiums would be around $9K.)

Individual mandate

The individual mandate was removed because Republicans didn’t like the idea of forcing people into buying insurance. Especially when Obamacare included so much. Maybe if the minimum only covered DVHC, it would have worked. Up in Canada we don’t force anyone to purchase a private benefit plan, though they’re available.

Summary

Ask any Canadian and the US system seems weird. Why wouldn’t you pass the money for doctor visits and hospital care through the fed? (What some are calling Medicare for All.) US private insurers would stay in business just like Great West Life. And this certainly makes sense. On the other hand, Americans don’t get hurt like you think.

Because of Medicaid, everyone gets hospital service. They just send you the bill. If you have a company plan, you’re good. Same goes if you’re poor, with the military, or over 65. The only people at risk are those with money not currently covered. If this is your position, purchase a plan.

Risktakers are only those who’d rather save the monthly premium (e.g., young people). If you have only $10,000 in assets, why not skip the monthly fee? Worse case, you lose the $10,000 when the hospital sues. Then you can go bankrupt over the rest.

Note: In Alberta, if you’re not covered by a company benefit plan, you can get one from the province for a monthly premium. It covers prescription drugs along with other items. Once you hit age 65, you’re automatically covered by this same plan without the cost.